CoinLedger Review - Is CoinLedger Tax Calculator Legit?

CoinLedger Review

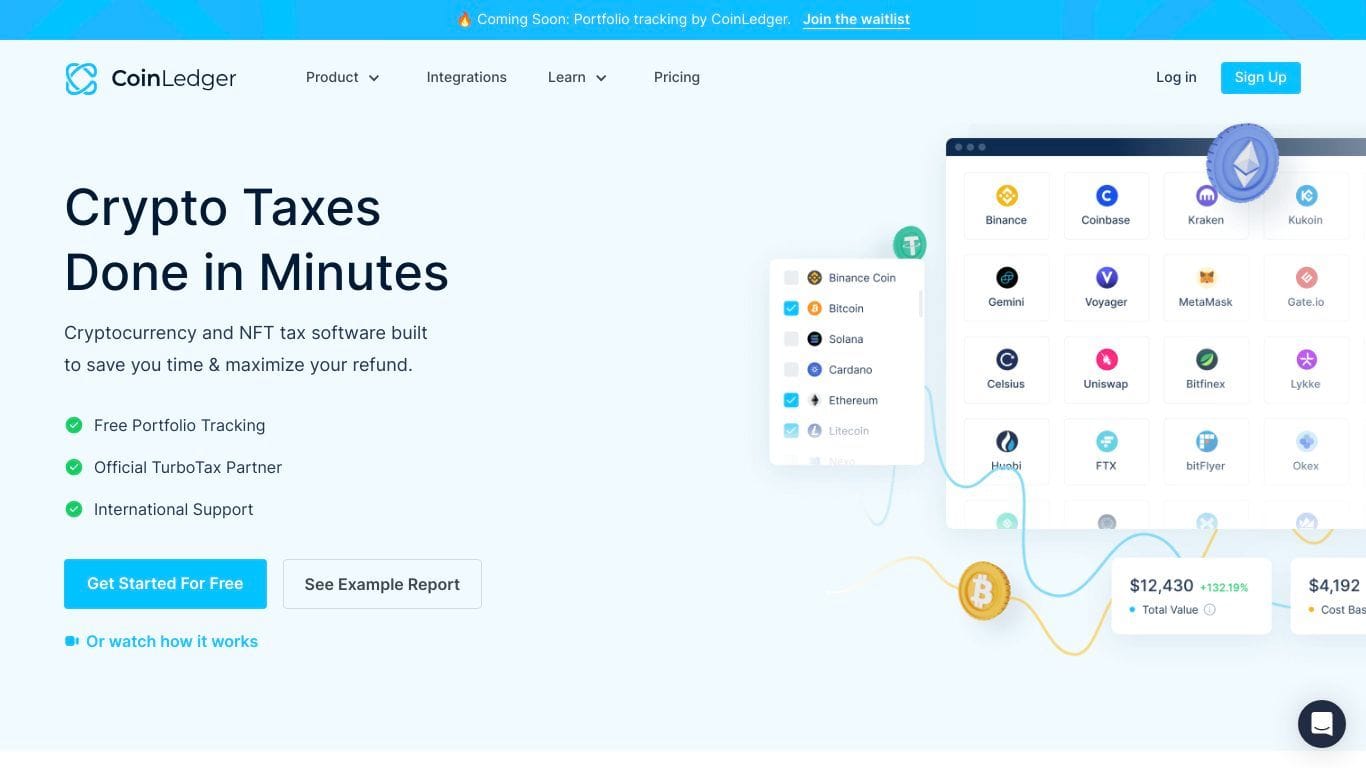

Discover how the CoinLedger Tax Calculator simplifies cryptocurrency tax filing with user-friendly features, robust security, and support for all digital assets, including NFTs.

CoinLedger Tax Calculator makes cryptocurrency tax filing a breeze by offering seamless integrations, accurate reporting, and support for NFTs. Learn why it’s a trusted tool for crypto enthusiasts.

Introduction

Navigating the complex world of cryptocurrency taxes can feel like walking a tightrope without a net. For crypto traders and enthusiasts, keeping track of transactions, calculating profits and losses, and staying compliant with tax regulations can be overwhelming. Enter the CoinLedger Tax Calculator – a tool designed to simplify this daunting task.

This review will explore what makes CoinLedger a trusted name among crypto users, from its features and pricing to its user-friendliness and security. Let’s dive in to see why CoinLedger is making waves in the crypto tax landscape.

# What is CoinLedger Tax Calculator?

The CoinLedger Tax Calculator is a cryptocurrency tax reporting tool that automates the process of calculating gains, losses, and taxable income for crypto users. Whether you’re a casual trader or a seasoned investor, this software simplifies tax reporting by integrating with popular crypto exchanges and wallets. It’s not just convenient – it’s essential for anyone dealing with digital assets.

Key Features:

- Support for All Cryptocurrencies and NFTs: From Bitcoin to niche altcoins and NFTs on platforms like OpenSea, CoinLedger covers it all.

- Seamless Integration: Compatible with major exchanges and wallets for quick data imports.

- Customizable Reports: Generate accurate tax reports for platforms like TurboTax or share them with your accountant.

- User-Friendly Design: Simplifies a traditionally complex process.

# How Does CoinLedger Work?

Using the CoinLedger Tax Calculator is as easy as pie. Here’s a step-by-step breakdown of how it works:

- Sign Up for Free: Create an account without any upfront commitment. The free plan lets users explore the platform before making a purchase.

- Import Transactions: Connect your exchanges and wallets using API keys or public wallet addresses. This ensures your transaction history is imported accurately.

- Review and Classify Data: Once your transactions are imported, review and categorize them. Identify sources like staking rewards, airdrops, or trades.

- Generate Tax Reports: With a click, create detailed reports that include capital gains, losses, and taxable income. These reports are ready for filing or can be uploaded to tax software.

# Why Choose CoinLedger Tax Calculator?

Advantages:

- Trusted by Over 300,000 Users: A proven track record of satisfied customers.

- Affordable Plans: Tiered pricing to suit everyone from hobbyists to professional traders.

- End-to-End Encryption: Ensures data privacy and security.

- Wide Compatibility: Works with all major exchanges, wallets, and NFT platforms.

Disadvantages:

- Some competitors offer free plans for low-volume users.

- Classifying certain transactions can require extra effort.

- Payments cannot be made using cryptocurrencies...

Full CoinLedger Review here! at https://scamorno.com/CoinLedger-Review-Tax-Calculator/?id=gbo

# Pricing Plans for CoinLedger Tax Calculator

The platform offers tiered pricing based on transaction volume, making it adaptable to various needs:

- Free Demo: Import transactions and explore the platform without generating reports.

- Hobbyist Plan: $49 for up to 100 transactions.

- Investor Plan: $99 for up to 1,000 transactions.

- Pro Plan: $199 for unlimited transactions.

All plans include a 14-day money-back guarantee, ensuring a risk-free experience.

# Is CoinLedger Safe to Use?

Absolutely! CoinLedger prioritizes user security through industry-standard practices, such as:

- End-to-End Encryption: Protects all data transmitted within the platform.

- Read-Only API Keys: Ensures no funds can be accessed or moved.

However, users must always safeguard their private keys and only share public wallet addresses when using the platform.

FAQs

1. What types of assets does CoinLedger support?

CoinLedger supports all cryptocurrencies, tokens, and NFTs from platforms like OpenSea, ensuring comprehensive coverage for all digital assets.

2. Can beginners use CoinLedger?

Yes, the platform is designed for both beginners and advanced users. The interface is intuitive, and the process is straightforward.

3. How long does it take to generate a tax report?

Once transactions are imported and categorized, reports can be generated in just a few clicks.

4. What payment options are available?

Users can pay using Visa, Mastercard, or American Express. A 14-day money-back guarantee applies to all plans.

5. Does CoinLedger integrate with tax software?

Yes, reports can be exported to TurboTax, TaxAct, or shared directly with a tax professional...

Full CoinLedger Review here! at https://scamorno.com/CoinLedger-Review-Tax-Calculator/?id=gbo