Financial Forecast Center Review: Is The Financial Forecast Center Llc Legit?

The Financial Forecast Center Review - Introduction

In today's fast-paced financial world, accurate predictions can be the difference between success and failure. That's where The Financial Forecast Center (FFC) comes into play. With a strong track record that dates back to 1997, this privately-owned Texas-based organization has made a name for itself by providing reliable economic and financial market forecasts. By utilizing advanced machine learning and artificial intelligence algorithms, The Financial Forecast Center has carved out a niche as a go-to source for quantitative forecasts. But what makes this service stand out? This review delves into the key features, methodology, and benefits of The Financial Forecast Center.

What Is The Financial Forecast Center?

The Financial Forecast Center is not just another forecasting service. Established in Houston, Texas, FFC has been producing and publishing market forecasts for over two decades. The organization uses a combination of cutting-edge AI technology and extensive historical data to generate forecasts for various financial indicators, including stock market indexes, interest rates, and currency exchange rates. These forecasts are exclusively available online, making them accessible to a global audience.

A Brief History of The Financial Forecast Center

Since its inception in 1997, The Financial Forecast Center has been dedicated to offering accurate and timely forecasts. Initially a part of Market Research International and Applied Reasoning Inc., FFC branched out in 2005 to focus solely on market forecasts. Meanwhile, Applied Reasoning Inc. turned its attention to developing artificial intelligence. This division allowed The Financial Forecast Center to hone its expertise in financial forecasting, ensuring that its models are among the best in the business.

Key Features of The Financial Forecast Center

What sets The Financial Forecast Center apart from other forecasting services? Let's take a closer look at some of its standout features.

1. Advanced Machine Learning Algorithms

At the core of The Financial Forecast Center's forecasting process are its sophisticated machine learning algorithms. These algorithms are designed to analyze vast amounts of data, identify patterns, and generate forecasts with high accuracy. The use of multiple algorithms ensures that the forecasts are not only reliable but also adaptable to changing market conditions.

2. Extensive Historical Data

To make accurate predictions, having access to comprehensive data is crucial. The Financial Forecast Center boasts a database that spans decades, covering a wide range of financial and economic indicators. This extensive dataset forms the foundation for the center's forecasting models, allowing them to capture long-term trends and patterns.

3. Data Transformations for Accuracy

Raw data is not always the best predictor of future outcomes. That's why The Financial Forecast Center transforms its data before feeding it into its AI algorithms. By applying mathematical transformations, such as logarithms, FFC enhances the predictive power of its models. This step is key to ensuring that the forecasts are as accurate as possible.

4. Comprehensive Coverage

The Financial Forecast Center doesn't just focus on one aspect of the market. Its forecasts cover a wide range of financial indicators, including:

- Stock market indexes (e.g., S&P 500, Dow Jones Industrial Average)

- Interest rates

- Currency exchange rates

- Commodity prices

- Economic indicators

This comprehensive coverage makes FFC a valuable resource for investors, analysts, and anyone interested in the financial markets.

5. Regular Updates

In the world of finance, timing is everything. The Financial Forecast Center understands this and provides regular updates to its forecasts. This ensures that users have access to the most current information, allowing them to make informed decisions.

6. User-Friendly Online Platform

Accessibility is another strength of The Financial Forecast Center. All forecasts are published exclusively online, making them easily accessible to users worldwide. The platform is designed to be user-friendly, with clear charts, diagrams, and explanations that make it easy to understand the forecasts.

How The Financial Forecast Center Works

The process of generating a forecast at The Financial Forecast Center is a complex one, involving several key steps. Here's a breakdown of how it works.

1. Data Collection

The first step in the forecasting process is data collection. The Financial Forecast Center carefully selects data from a variety of sources, including stock market indexes, interest rates, and other economic indicators. This data is chosen for its relevance and reliability.

2. Data Transformation

Once the data is collected, it undergoes a series of transformations. These transformations are designed to improve the accuracy of the forecasts. For example, instead of using raw stock market index values, FFC may apply logarithms to the data. This step ensures that the data is in the best possible form for analysis...

3. Machine Learning and AI Algorithms

With the transformed data in hand, The Financial Forecast Center applies its machine learning and AI algorithms. These algorithms analyze the data, identify patterns, and generate forecasts. The use of multiple algorithms ensures that the forecasts are robust and adaptable to different market conditions.

4. Forecast Generation

Finally, the forecasts are generated. These forecasts are then published on The Financial Forecast Center's website, where users can access them. The forecasts are presented in a clear and easy-to-understand format, with charts and diagrams that help users visualize the data.

Why Choose The Financial Forecast Center?

With so many forecasting services available, why should you choose The Financial Forecast Center? Here are a few reasons.

1. Proven Track Record

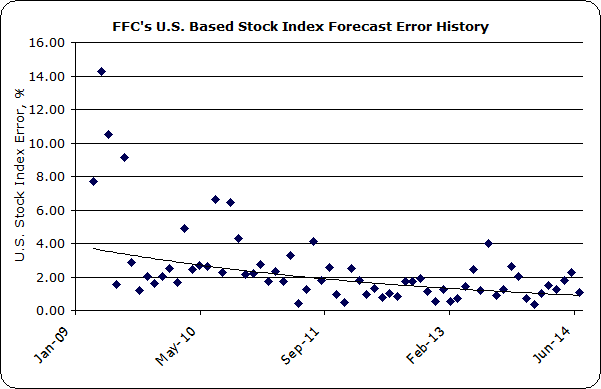

With over two decades of experience, The Financial Forecast Center has a proven track record of delivering accurate and reliable forecasts. Its long history and extensive experience make it a trusted name in the world of financial forecasting.

2. Cutting-Edge Technology

The use of advanced machine learning and AI algorithms sets The Financial Forecast Center apart from its competitors. These technologies allow FFC to generate forecasts that are not only accurate but also adaptable to changing market conditions.

3. Comprehensive Coverage

The Financial Forecast Center covers a wide range of financial indicators, making it a one-stop-shop for all your forecasting needs. Whether you're interested in stock market indexes, interest rates, or currency exchange rates, FFC has you covered.

4. Regular Updates

In the fast-paced world of finance, having access to the most current information is crucial. The Financial Forecast Center provides regular updates to its forecasts, ensuring that users always have access to the latest data.

5. User-Friendly Platform

The Financial Forecast Center's online platform is designed with the user in mind. The forecasts are presented in a clear and easy-to-understand format, with charts and diagrams that help users visualize the data.

Frequently Asked Questions (FAQs)

1. What is The Financial Forecast Center?

The Financial Forecast Center is a Texas-based organization that provides economic and financial market forecasts using advanced machine learning and AI algorithms.

2. How does The Financial Forecast Center generate its forecasts?

The Financial Forecast Center collects data from a variety of sources, transforms it to improve accuracy, and then applies machine learning and AI algorithms to generate forecasts.

3. What financial indicators does The Financial Forecast Center cover?

The Financial Forecast Center covers a wide range of financial indicators, including stock market indexes, interest rates, currency exchange rates, commodity prices, and economic indicators.

4. How often are the forecasts updated?

The Financial Forecast Center provides regular updates to its forecasts, ensuring that users always have access to the most current information.

5. Is The Financial Forecast Center's platform user-friendly?

Yes, The Financial Forecast Center's online platform is designed to be user-friendly, with clear charts, diagrams, and explanations that make it easy to understand the forecasts...